UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DCD.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a partyParty other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to Rule 14a-12under §240.14a-12 |

PROVECTUS BIOPHARMACEUTICALS, INC.

Provectus Biopharmaceuticals, Inc.

(Name of Registrantregistrant as Specified In Its Charter)specified in its charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement,person(s) filing proxy statement, if other than the Registrant)registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required.required |

| |

| ☐ | Fee paid previously with preliminary materials |

| |

| ☐ | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 |

| Title of each class of securities to which transaction applies:800 S. Gay Street, Suite 1610

Knoxville, Tennessee 37929 |

| | (2) | | Aggregate number of securities to which transaction applies:phone 866/594-5999

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

| |

☐ | | Fee paid previously with preliminary materials. |

| |

☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by Registration Statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing party:

|

| | (4) | | Date Filed:

fax 866/998-0005 |

Dear Provectus Stockholder:

| | |

| | 7327 Oak Ridge Highway

Knoxville, TN 37931

phone 866/594-5999

fax 866/998-0005

|

Dear Stockholder:

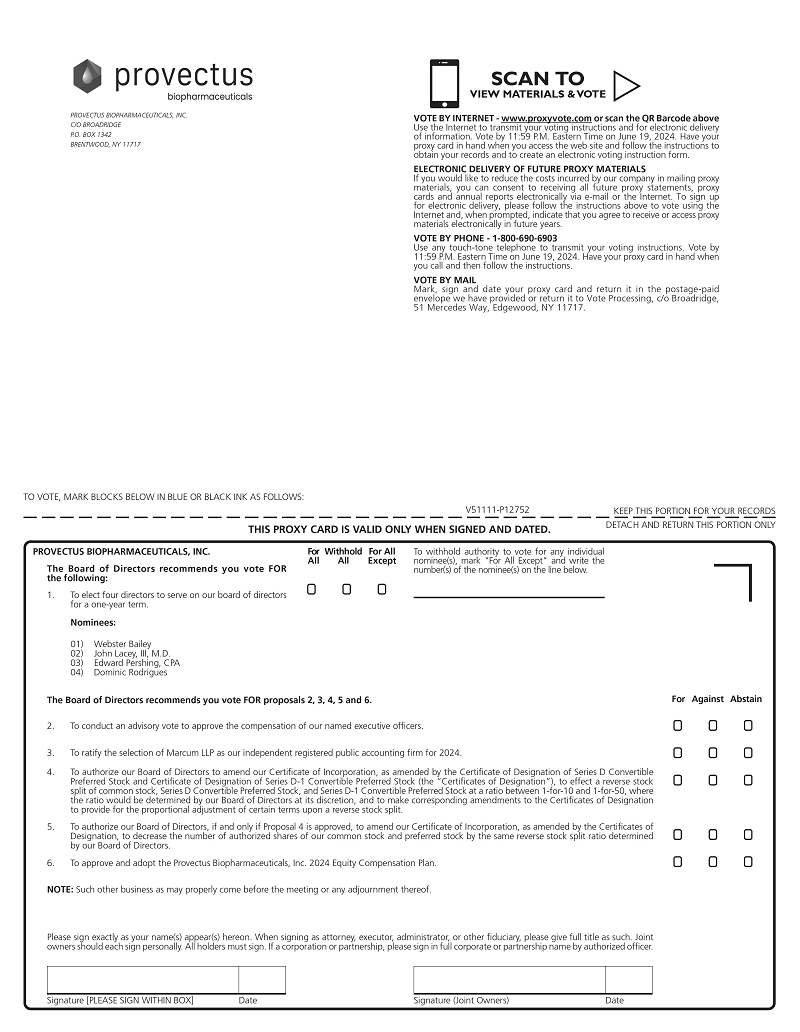

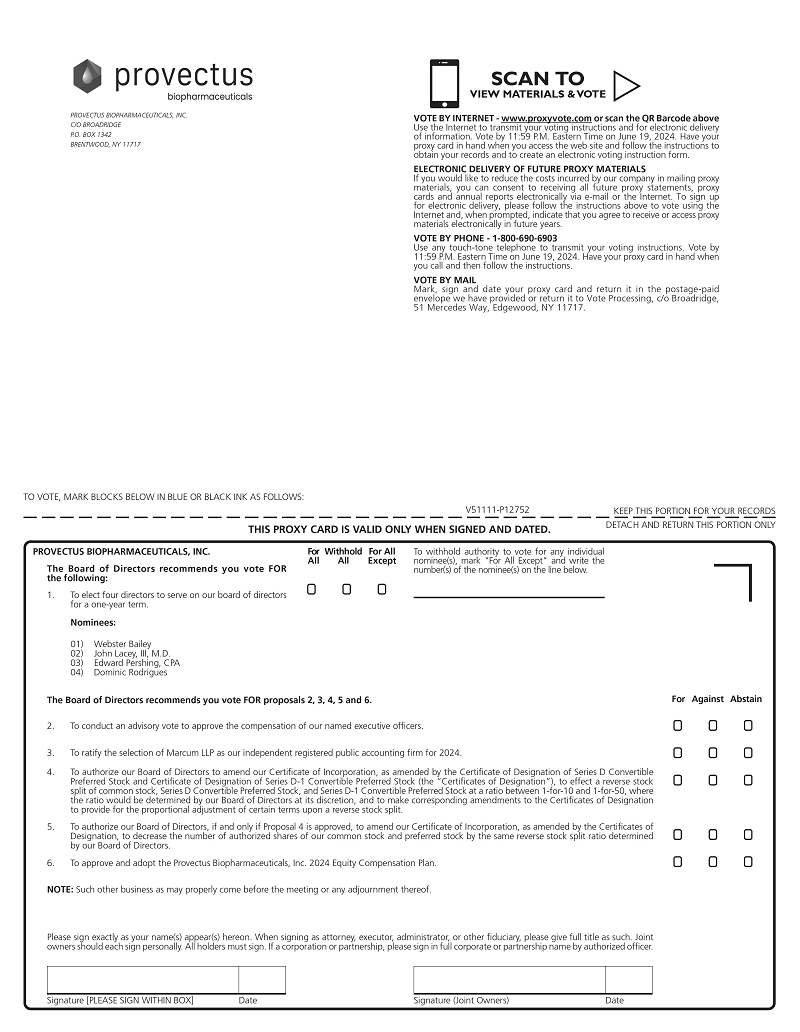

You are cordially invited to attend a special meetingthe 2024 Annual Meeting of stockholders, which will be heldStockholders of Provectus Biopharmaceuticals, Inc. (“Provectus”) on Monday, November 28, 2016 at 9:00 a.m. Eastern Standard TimeThursday, June 20, 2024 at the offices of Baker, Donelson, Bearman, Caldwell & Berkowitz, PC,Hilton Knoxville located at 265 Brookview Centre Way, Suite 600,501 West Church Avenue, Knoxville, Tennessee 37919.

The Notice and Proxy Statement on the following pages contain details concerning the business37902, beginning at 4:00 p.m. Eastern Time (the “2024 Annual Meeting”). We intend to come before the special meeting.

Regardless of whether you plan to attend the specialhold our annual meeting in person, please complete, sign and dateperson. As always, we encourage you to vote your shares prior to the enclosed proxy card and return it promptly in the accompanying postage-paid envelope. I look forward to personally meeting all stockholders who are able to attend the special meeting.

Peter R. Culpepper

Interim Chief Executive Officer, Chief

Operating OfficerWe are pleased to present you with our 2024 Proxy Statement. At our 2024 Annual Meeting, stockholders will vote on the matters set forth in the 2024 Proxy Statement and Secretary

YOUR VOTE IS IMPORTANTthe accompanying notice of this meeting. Your board of directors (the “Board”) has recommended four highly qualified and experienced nominees for election to Provectus’s Board at the 2024 Annual Meeting. Highlights of the detailed information included in the Proxy Statement may be found in the section entitled “Questions and Answers About the 2024 Annual Meeting of Stockholders,” starting on page 2. Detailed information regarding director candidates may be found under “Proposal 1 – Election of Directors,” starting on page 18.

TO ENSURE THAT YOU ARE REPRESENTED AT THE SPECIAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE, REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE SPECIAL MEETING IN PERSON. NO ADDITIONAL POSTAGE IS NECESSARY IF THE PROXY IS MAILED IN THE UNITED STATES. YOU MAY REVOKE YOUR PROXY AT ANY TIME BEFORE IT IS VOTED AT THE SPECIAL MEETING.

Whether you will attend the 2024 Annual Meeting or not, we hope that your shares are represented and voted. In advance of the meeting on June 20, 2024, please vote and submit your proxy as soon as possible via the Internet, by telephone, or, if you have requested to receive printed proxy materials, by mailing the proxy or voting instruction card enclosed with those materials. Instructions on how to vote are found in the section entitled “Questions and Answers About the 2024 Annual Meeting of Stockholders – How do I vote before the Annual Meeting?” starting on page 4.

For more information and up-to-date postings, please visit www.provectusbio.com/annual-meeting.

Thank you for being a Provectus stockholder.

| | Sincerely, |

| |

| /s/ Dominic Rodrigues |

| Dominic Rodrigues |

| President |

| 7327 Oak Ridge Highway800 S. Gay Street, Suite 1610

Knoxville, TN 37931Tennessee 37929 phone866/594-5999

fax866/998-0005 |

NOTICE OF SPECIAL2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 28, 2016THURSDAY, JUNE 20, 2024

To the Stockholders of Provectus Biopharmaceuticals, Inc.:

NOTICE IS HEREBY GIVEN that a special meetingwe will hold the 2024 Annual Meeting of Stockholders (the “Special Meeting”) of Provectus Biopharmaceuticals, Inc. (“Provectus” or the “Company”) will be held on Monday, November 28, 2016 at 9:00 a.m. Eastern Standard TimeThursday, June 20, 2024, at the offices of Baker, Donelson, Bearman, Caldwell & Berkowitz, PC,Hilton Knoxville located at 265 Brookview Centre Way, Suite 600,501 West Church Avenue, Knoxville, TN 37919. Tennessee 37902, beginning at 4:00 p.m. Eastern Time. As always, we encourage you to vote your shares prior to the meeting.

The Special2024 Annual Meeting is being held for the following purposes:

| | 1. | To approve and adopt an amendmentelect four directors to serve on our CertificateBoard of Incorporation, as amended, to increase the number of shares of common stock, par value $.001 per share (“common stock”), that we are authorized to issue from 400,000,000 to 1,000,000,000 shares; andDirectors; |

| | |

| | 2. | To conduct an advisory vote to approve the compensation of our named executive officers; |

| 3. | To ratify the selection of Marcum LLP as our independent registered public accounting firm for 2024; |

| 4. | To authorize our Board of Directors to amend our Certificate of Incorporation, as amended by the Certificate of Designation of Series D Convertible Preferred Stock and Certificate of Designation of Series D-1 Convertible Preferred Stock (the “Certificates of Designation”), to effect a reverse stock split of our common stock, Series D Convertible Preferred Stock, and Series D-1 Convertible Preferred Stock at a ratio of between 1-for-10 and 1-for-50, suchwhere the ratio towould be determined by our Board of Directors inat its discretion.discretion, and to make corresponding amendments to the Certificates of Designation to provide for the proportional adjustment of certain terms upon a reverse stock split; |

| | |

| 5. | To authorize our Board of Directors, if and only if Proposal 4 is approved, to amend our Certificate of Incorporation, as amended by the Certificates of Designation, to decrease the number of authorized shares of our common stock and preferred stock by the same reverse stock split ratio determined by our Board of Directors; and |

| | |

| 6. | To approve and adopt the Provectus Biopharmaceuticals, Inc. 2024 Equity Compensation Plan. |

Stockholders also maywould transact any other business that properly comes before the Special2024 Annual Meeting.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE FOUR DIRECTOR NOMINEES WHO ARE IDENTIFIED IN THE PROXY STATEMENT, AND “FOR” EACH OF PROPOSALS 1 AND 2.2, 3, 4, 5, and 6.

Only stockholders of record as of the close of business on October 17, 2016April 24, 2024, will be entitled to notice of and to vote at the Special2024 Annual Meeting of Stockholders and any adjournment thereof.

We are mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders instead of paper copies of our proxy statement and annual report. The Notice contains instructions for accessing those documents over the Internet. The Notice also contains instructions on how stockholders can receive a paper copy of our proxy materials, including the proxy statement, our 2024 Annual Report, and the proxy card.

We hope that you will be able to attend the 2024 Annual Meeting. Whether or not you plan to attend the meeting, we ask that you vote as soon as possible. Prompt voting helps to ensure that the greatest number of stockholders are present, whether in person or by proxy. You may vote over the Internet, by telephone, or, if you requested to receive printed proxy materials, by mailing the proxy or voting instruction card enclosed with these meeting materials. Please review the instructions for each of your voting options described in the proxy statement, as well as in the Notice you received in the mail.

If you attend the 2024 Annual Meeting in person, you may revoke your proxy at the meeting and vote your shares in person. You may revoke your proxy at any time before the proxy is exercised. Should you desire to revoke your proxy, you may do so as provided in the accompanying proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the Special2024 Annual Meeting of Stockholders to Be Held on November 28, 2016. ThisThursday, June 20, 2024. The Notice of Internet Availability of Proxy Materials, this Proxy Statement isand our Annual Report on Form 10-K for the year ended December 31, 2023 are available at http://www.pvct.com/annual_reports.html.

By order of our Board of Directors,www.proxyvote.com.

| By order of our board of directors, |

| |

| /s/ Dominic Rodrigues |

| Dominic Rodrigues |

| President |

| |

| May 6, 2024 | |

| Knoxville, Tennessee | |

Peter R. Culpepper

Secretary

November 2, 2016

Knoxville, Tennessee

TABLE OF CONTENTS

| | |

|  | 7327 Oak Ridge Highway

800 S. Gay Street, Suite 1610

Knoxville, TN 37931Tennessee 37929 phone 865/769-4011

866/594-5999 fax 865/769-4013866/998-0005 |

PROXY STATEMENT FOR

SPECIAL2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 28, 2016JUNE 20, 2024

We are delivering these proxy materials to solicit proxies on behalf of the Boardboard of Directorsdirectors of Provectus Biopharmaceuticals, Inc. (“we,” “us,” “Provectus,” or the “Company”), for a special meetingthe 2024 Annual Meeting of stockholders and any adjournment thereof (the “Special Meeting”). The Special MeetingStockholders that will be held on Monday, November 28, 2016 at 9:00 a.m. Eastern Standard TimeThursday, June 20, 2024, at the offices of Baker, Donelson, Bearman, Caldwell & Berkowitz, PC,Hilton Knoxville located at 265 Brookview Centre Way, Suite 600,501 West Church Avenue, Knoxville, TN 37919.Tennessee 37902, beginning at 4:00 p.m. Eastern Time. We intend to hold our 2024 Annual Meeting in person. Please monitor our meeting website at www.provectusbio.com for updated information. If you are planning to attend our meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the meeting.

We are mailingwill mail the Notice of Internet Availability of Proxy Materials to our stockholders on or about May 10, 2024.

We will refer to Provectus Biopharmaceuticals, Inc. and its subsidiaries throughout this Proxy Statement together with a formas “we,” “us,” the “Company,” or “Provectus.” We will refer to the board of proxy, ondirectors as the “Board” or about November 2, 2016.“our Board.”

At the Special2024 Annual Meeting, our stockholders will vote on proposals to (1) approve and adopt an amendment to our Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to increase the number of authorized shares of common stock, par value $.001 per share (“common stock”), that we are authorized to issue from 400,000,000 to 1,000,000,000 shares and (2) authorize our Board of Directors to amend our Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio of between 1-for-10 and 1-for-50, such ratio to be determined by our Board of Directors in its discretion (the “Reverse Stock Split”). Thesesix proposals:

| 1. | To elect four directors to serve on our Board; |

| | |

| 2. | To conduct an advisory vote to approve the compensation of our named executive officers; |

| | |

| 3. | To ratify the selection of Marcum LLP (“Marcum”) as our independent registered public accounting firm for 2024; |

| | |

| 4. | To authorize our Board to amend our Certificate of Incorporation, as amended by the Certificate of Designation of Series D Convertible Preferred Stock and Certificate of Designation of Series D-1 Convertible Preferred Stock (the “Certificates of Designation”), to effect a reverse stock split of our common stock, Series D Convertible Preferred Stock, and Series D-1 Convertible Preferred Stock at a ratio between 1-for-10 and 1-for-50, where the ratio would be determined by our Board at its discretion, and to make corresponding amendments to the Certificates of Designation to provide for the proportional adjustment of certain terms upon a reverse stock split; |

| | |

| 5. | To authorize our Board, if and only if Proposal 4 is approved, to amend our Certificate of Incorporation, as amended by the Certificates of Designation, to decrease the number of authorized shares of our common stock and preferred stock by the same reverse stock split ratio determined by our Board; and |

| | |

| 6. | To approve and adopt the Provectus Biopharmaceuticals, Inc. 2024 Equity Compensation Plan. |

The proposals are set forth in the accompanying Notice of Special2024 Annual Meeting of Stockholders and are described in more detail in this Proxy Statement. Stockholders also willmay transact any other business not known or determined at the time of this proxy solicitation and that properly comes before the Special2024 Annual Meeting althoughof Stockholders (the “2024 Annual Meeting”); however, our Board of Directors knows of no such other business to be presented.business.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE FOUR BOARD NOMINEES WHO ARE IDENTIFIED IN THE PROXY STATEMENT, AND “FOR” EACH OF PROPOSALS 12, 3, 4, 5, AND 2.6.

When you submit your proxy, by executing and returning the enclosed proxy card, you will authorize the proxy holders – Peter R. CulpepperDominic Rodrigues, President and Timothy C. Scott –Heather Raines, CPA, Chief Financial Officer, to vote as proxy all your shares of common stock and/or preferred stock and otherwise to act on your behalf at the Special2024 Annual Meeting and any adjournment thereof, in accordance with the instructions set forth therein. These persons also will have discretionary authority to vote your shares on any other business that properly comes before the Special2024 Annual Meeting. They also may vote your shares to adjourn the meeting2024 Annual Meeting and will be authorized to vote your shares at any adjournment of the meeting.meeting adjournment.

YOUR VOTE IS IMPORTANT

TO ENSURE THAT YOU ARE REPRESENTED AT THE SPECIAL MEETING, PLEASE COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE, REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE SPECIAL MEETING IN PERSON. NO ADDITIONAL POSTAGE IS NECESSARY IF THE PROXY IS MAILED IN THE UNITED STATES. YOU MAY REVOKE YOUR PROXY AT ANY TIME BEFORE IT IS VOTED AT THE SPECIAL MEETING.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL2024 ANNUAL MEETING OF STOCKHOLDERS

What are

Why did I receive a one-page notice in the purposesmail regarding Internet availability of proxy materials for the 2024 Annual Meeting of Stockholders instead of a full set of proxy materials?

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), the Company uses the Internet as the primary means of furnishing proxy materials to stockholders. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to the Company’s stockholders. All stockholders will have the ability to electronically access the proxy materials referred to in the Notice. They may also request a printed set of the Special Meeting?complete proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials electronically by email or in printed form by mail on an ongoing basis. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the costs and environmental impact of the Company’s annual meetings associated with the physical printing and mailing of meeting materials.

What is the purpose of the 2024 Annual Meeting of Stockholders?

At the Special2024 Annual Meeting, stockholders willwould act upon the following matters:

PROPOSAL 1. To approve and adopt an amendment to our Certificate of Incorporation, as amended, to increase the number of shares of common stock that we are authorized to issue from 400,000,000 to 1,000,000,000 shares.

| 1. | To elect four directors to serve on our Board; |

| | |

| 2. | To conduct an advisory vote to approve the compensation of our named executive officers; |

| | |

| 3. | To ratify the selection of Marcum as our independent registered public accounting firm for 2024; |

| | |

| 4. | To authorize our Board to amend our Certificate of Incorporation, as amended by the Certificates of Designation, to effect a reverse stock split of our common stock, Series D Convertible Preferred Stock, and Series D-1 Convertible Preferred Stock at a ratio between 1-for-10 and 1-for-50, where the ratio would be determined by our Board at its discretion, and to make corresponding amendments to the Certificates of Designation to provide for the proportional adjustment of certain terms upon a reverse stock split; |

| 5. | To authorize our Board, if and only if Proposal 4 is approved, to amend our Certificate of Incorporation, as amended by the Certificates of Designation, to decrease the number of authorized shares of our common stock and preferred stock by the same reverse stock split ratio determined by our Board; and |

| | |

| 6. | To approve and adopt the Provectus Biopharmaceuticals, Inc. 2024 Equity Compensation Plan. |

PROPOSAL 2. To authorize our Board of Directors to amend our Certificate of Incorporation, as amended, to effect a reverse stock split of our common stock at a ratio of between 1-for-10 and 1-for-50, such ratio to be determined by our Board of Directors in its discretion.

Stockholders also willmay transact any other business not known or determined at the time of this proxy solicitation that properly comes before the Special Meeting, although2024 Annual Meeting; however, our Board of Directors knows of no such other business to be presented.business.

Who is entitled to vote?

Only stockholders of record at the close of business on October 17, 2016,April 24, 2024, the record date for the Special2024 Annual Meeting, are entitled to receive notice of the Special2024 Annual Meeting and to vote the shares of common stock, Series D Convertible Preferred Stock, or Series D-1 Convertible Preferred Stock that they held on that date at the record date.meeting. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted on at the Special2024 Annual Meeting.

Am I entitled Each outstanding share of Series D Convertible Preferred Stock carries the right to one vote if my shares are held in “street name?”

If you areper share. Each outstanding share of Series D-1 Convertible Preferred Stock carries the beneficial ownerright to ten (10) votes per share. Holders of shares held in “street name” byof Series D Convertible Preferred Stock and Series D-1 Convertible Preferred Stock will vote together with the holders of common stock as a brokerage firm, bank, orsingle class on all matters submitted to stockholders and such other nominee, such entity,matters as may properly come before the record holder of the shares, is required to vote the shares in accordance with your instructions. If you do not give instructions to your nominee, it will nevertheless be entitled to vote your shares on “discretionary” items but will not be permitted to do so on “non-discretionary” items. Proposals 1Annual Meeting and 2 are discretionary items on which your nominee will be entitled to vote your shares even in the absence of instructions from you.any adjournments.

What constitutes a quorum?

The presence at the Special2024 Annual Meeting in person or by proxy, of the holders of a majority of the shares of common stock, Series D Convertible Preferred Stock, and Series D-1 Convertible Preferred Stock outstanding on the record date, April 24, 2024, in person or by proxy, will constitute a quorum. As of the record date, there were 243,895,352 outstanding shares of common stock. Shares held by stockholders present at the Special Meeting in person or represented by proxy at the 2024 Annual Meeting who elect to abstain from voting nonetheless will be included in the calculation of the number of shares considered present at the Special Meeting.meeting.

As of April 14, 2024, there were 419,522,119 shares of common stock, 12,373,247 shares of Series D Convertible Preferred Stock, and 10,634,761 shares of Series D-1 Convertible Preferred Stock outstanding.

What happens if a quorum is not present at the Special Meeting?2024 Annual Meeting of Stockholders?

If a quorum is not present at the scheduled time of the Special2024 Annual Meeting, the holders of a majority of the shares of common stock, Series D Preferred Stock, and Series D-1 Preferred Stock present in person or represented by proxy at the meeting may adjourn the meeting to another place, date, and/or time until a quorum is present. The place, date, and time of the adjourned meeting will be announced when the adjournment is taken, and no other notice will be given unless the adjournment is for more than thirty30 days or if after the adjournment a new record date is fixed for the adjourned meeting.meeting after the adjournment.

How doMay I vote?

If you complete and properly sign the accompanying proxy card and return it to us, the proxy holders named on the proxy card will vote yourmy shares as you direct. If you are a registered stockholder and attend the Special

Meeting, you may deliver your completed proxy card or vote in person at the Special Meeting.2024 Annual Meeting of Stockholders?

Yes. You may vote your shares at the 2024 Annual Meeting if you attend in person, even if you previously submitted a proxy card or voted by Internet or telephone. Whether you plan to attend the 2024 Annual Meeting in person or not, in order to assist us in tabulating votes at the meeting, we encourage you to vote by using the Internet, by telephone, or, if applicable, by returning a proxy card.

How do I vote before the 2024 Annual Meeting of Stockholders?

Before the 2024 Annual Meeting, you may vote your shares in one of the following three ways:

| 1. | By the Internet, by following the instructions provided in the Notice; |

| | |

| 2. | By mail, if you requested printed copies of the proxy materials, by filling out the form of proxy card and sending it back in the envelope provided; or |

| | |

| 3. | By telephone, if you requested printed copies of the proxy materials, by calling the toll-free number found on the proxy card. If you requested printed copies of the proxy materials, and properly sign and return your proxy card and return it in the prepaid envelope, your shares will be voted as you direct. |

Please use only one of the above three ways to vote. If you hold shares in the name of a broker, your ability to vote those shares by Internet or by telephone depends on the voting procedures used by your broker, as explained below.

How do I vote if my broker holds my shares in “street name?”

If your shares are held in “street name,” your bank or broker will send you the Notice. Many, but not all, banks and brokerage firms participate in a program provided through our transfer agent Broadridge Financial Solutions, Inc. that offers Internet and telephone voting options. If you do not give instructions to your nominee, it will be entitled to vote your shares on “discretionary” items but will not be permitted to do so on “non-discretionary” items. Proposals 1, 2 and 6 are non-discretionary items for which a nominee will not have discretion to vote in the absence of voting instructions from you. Proposals 3, 4, and 5 are discretionary items for which your nominee will be entitled to vote your shares in a brokerage account or in “street name” and you wish to vote at the Special Meeting, you will need to obtain a proxyabsence of instructions from the broker or other nominee who holds your shares.you.

Can I change my vote after I returnmind and revoke my proxy card?proxy?

Yes. Even after you have submitted your proxy card, you may change your vote at any time before the proxy is exercised by filing with the Secretary either a notice of revocation or a duly executed proxy card bearing a later date. If you are a “street name” stockholder, you must contact your broker or other nominee and follow its instructions if you wish to change your vote. The powers of the proxy holders will be suspended if you attend the Special Meeting in person and so request, although your attendance at the Special Meeting will not by itselfTo revoke a previously granted proxy.proxy pursuant to this solicitation, you must:

| ● | Sign another proxy with a later date, and return it to our Secretary, Provectus Biopharmaceuticals, Inc., 800 S. Gay Street, Suite 1610, Knoxville, Tennessee 37929 at or before the 2024 Annual Meeting; |

| | |

| ● | Provide our Secretary with a written notice of revocation dated later than the date of the original proxy at or before the meeting; |

| | |

| ● | Re-vote by using the telephone following the instructions on the proxy card; |

| | |

| ● | Re-vote by using the Internet by following the instructions in the Notice; or |

| | |

| ● | Attend the 2024 Annual Meeting and vote in person. Note that attendance at the meeting will not revoke a proxy if you do not actually vote at the meeting. |

What isare the Board’s recommendation?recommendations?

Our Board of Directors unanimously recommends that you vote:

| | 1. | “FOR”the proposal to elect four directors to serve on our Board; |

| | |

| 2. | “FOR” the proposal to approve, and adopton an amendment toadvisory basis, the compensation of our Certificate of Incorporation, as amended, to increase the number of shares of common stock that we are authorized to issue from 400,000,000 to 1,000,000,000 shares; andnamed executive officers; |

| | 2. | |

| 3. | “FOR”the proposal to ratify the selection of Marcum as our independent registered public accounting firm for 2024; |

| | |

| 4. | “FOR” the proposal to authorize our Board of Directors to amend our Certificate of Incorporation, as amended by the Certificates of Designation, to effect a reverse stock split of our common stock, Series D Convertible Preferred Stock, and Series D-1 Convertible Preferred Stock at a ratio of between 1-for-10 and 1-for-50, suchwhere the ratio towould be determined by our Board at its discretion, and to make corresponding amendments to the Certificates of Directors in its discretion.Designation to provide for the proportional adjustment of certain terms upon a reverse stock split; |

| | |

| 5. | “FOR” the proposal to authorize our Board, if and only if Proposal 4 is approved, to amend our Certificate of Incorporation, as amended by the Certificates of Designation, to decrease the number of authorized shares of our common stock and preferred stock by the same reverse stock split ratio determined by our Board; and |

| | |

| 6. | “FOR” the approval of the Provectus Biopharmaceuticals, Inc. 2024 Equity Compensation Plan. |

What happens if I do not specify how my shares are to be voted?

If you submit asign and return your proxy card or complete the telephone or Internet voting procedures but do not indicate any voting instructions, your shares will be voted“FOR” each of Proposalsthe director nominees who are identified in Proposal 1 and 2.“FOR” Proposals 2, 3, 4, 5, and 6.

Will any other business be conducted at the Special Meeting?2024 Annual Meeting of Stockholders?

As of the date hereof, our Board of Directors knows of no business that willwould be presented at the Special2024 Annual Meeting other than the proposals described in this Proxy Statement. If any other business is properly brought before the Special Meeting,meeting, the proxy holders will vote your shares in accordance with their best judgment.

What vote is required to approve each item?

The proposal to approve and adopt an amendment to our Certificate of Incorporation to increase

| 1. | The director nominees would be elected to serve on our Board if they receive a plurality of the votes cast on the number of shares of common stock that we are authorized to issue from 400,000,000 to 1,000,000,000 shares will be approved if a majority of the outstanding shares of common stock are voted in favor of the proposal. The proposal to authorize our Board of Directors to amend our Certificate of Incorporation to effect a reverse stock split of our common stock at a ratio of between 1-for-10 and 1-for-50, such ratio to be determined by our Board of Directors in its discretion, will be approved if a majority of the outstanding shares of common stock, Series D Convertible Preferred Stock (voting on an as converted basis with the common stock), and Series D-1 Convertible Preferred Stock (voting on an as converted basis with the common stock) present in person or represented by proxy at the 2024 Annual Meeting and entitled to vote on the subject matter. This means that the director nominees would be elected if they receive more votes than any other person at the meeting. If you vote to “Withhold Authority” with respect to the election of one or more director nominees, your shares of common stock and/or preferred stock will not be voted with respect to the person or persons indicated; however, they will be counted for the purpose of determining whether there is a meeting quorum. |

| 2. | The advisory vote to approve the compensation of our named executive officers would be approved if a majority of the shares of common stock, Series D Convertible Preferred Stock (voting on an as converted basis with the common stock), and Series D-1 Convertible Preferred Stock (voting on an as converted basis with the common stock) present in person or represented by proxy at the 2024 Annual Meeting and entitled to vote on the subject matter are voted in favor of the proposal. |

| 3. | The selection of Marcum as our independent registered public accounting firm for 2024 would be ratified if a majority of the shares of common stock, Series D Convertible Preferred Stock (voting on an as converted basis with the common stock), and Series D-1 Convertible Preferred Stock (voting on an as converted basis with the common stock) present in person or represented by proxy at the meeting and entitled to vote on the subject matter are voted in favor of the proposal. |

| | |

| 4. | The proposal to authorize our Board to amend our Certificate of Incorporation, as amended by the Certificates of Designation, to effect a reverse stock split of our common stock, Series D Convertible Preferred Stock, and Series D-1 Convertible Preferred Stock at a ratio between 1-for-10 and 1-for-50, where the ratio would be determined by our Board at its discretion, and to make corresponding amendments to the Certificates of Designation to provide for the proportional adjustment of certain terms upon a reverse stock split, will be approved if a majority of the outstanding shares of common stock, Series D Convertible Preferred Stock (voting on an as converted basis with the common stock), and Series D-1 Convertible Preferred Stock (voting on an as converted basis with the common stock) are voted in favor of the proposal. |

| | |

| 5. | The proposal to authorize our Board, if and only if Proposal 4 is approved, to amend our Certificate of Incorporation, as amended by the Certificates of Designation, to decrease the number of shares of common stock and preferred stock that we are authorized to issue by the same reverse stock split ratio, will be approved if a majority of the outstanding shares of common stock, Series D Convertible Preferred Stock (voting on an as converted basis with the common stock), and Series D-1 Convertible Preferred Stock (voting on an as converted basis with the common stock) are voted in favor of the proposal. |

| | |

| 6. | The approval of our 2024 Equity Compensation Plan will be approved if a majority of the shares of common stock, Series D Convertible Preferred Stock (voting on an as converted basis with the common stock), and Series D-1 Convertible Preferred Stock (voting on an as converted basis with the common stock) present in person or represented by proxy at the meeting and entitled to vote on the subject matter are voted in favor of the proposal. |

In addition, the holders of a majority of our outstanding shares of Series B Convertible Preferred Stock must consent in writing to the Reverse Stock Split before we may effectuate the Reverse Stock Split.

How will abstentions and broker non-votes be treated?

You do not have the option of abstaining from voting on Proposal 1. You may abstain from voting on Proposals 2, 3, 4, 5, and 6. With respect to Proposal 1, because the directors are elected by a plurality vote, an abstention will have no effect on the outcome of the vote and, therefore, is not offered as a voting option on the proposal. In the case of an abstention on the proposal,Proposals 2, 3, 4, 5, and 6, your shares of common stock, wouldSeries D Convertible Preferred Stock, or Series D-1 Convertible Preferred Stock will be included in the number of shares of common stock, Series D Convertible Preferred Stock, or Series D-1 Convertible Preferred Stock considered present at the meeting for the purpose of determining whether there is a quorum. Because your shares of common stock, Series D Convertible Preferred Stock, or Series D-1 Convertible Preferred Stock would not be voted but not in favor of Proposals 12, 3, 4, 5, and 2,6, your abstention would have the same effect as a negative vote in determining the outcome of the vote on Proposals 1 and 2.

these proposals.Broker non-votes occur when a bank, brokerage firm, bank, or other nominee does not vote shares that it holds in “street name” on behalf of the beneficial owner because the beneficial owner has not provided voting instructions to the nominee with respect to a non-discretionary item. Proposals 1, 2, and 26 are non-discretionary items for which a nominee will not have discretion to vote in the absence of voting instructions from you. Proposals 3, 4 and 5, however, are discretionary items on which your nominee will be entitled to vote your shares of common stock, Series D Convertible Preferred Stock, or Series D-1 Convertible Preferred Stock even in the absence of instructions from you. Accordingly, there will not beIn the case of a broker non-votes with regard to Proposals 1 and 2.

Who is the solicitation agent in connection with the Special Meeting?

We have engaged Morrow Sodali to assist us in the solicitation of proxies for the Special Meeting. If you have any questions or require assistance in votingnon-vote, your shares of common stock, please call:

Morrow Sodali

470 West Avenue – 3rd Floor

Stamford, CT 06902

Banks and Brokerage Firms, please call (203) 658-9400

Stockholders, please call toll free (800) 461-0945

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, that are based on expectations, estimates and projections as of the date of this Proxy Statement. These forward-looking statements include, but are not limited to, statements and information concerning statements regarding:

our effectuation of the amendment to our Certificate of Incorporation to increase the number of shares of common stock we are authorized to issue and the ReverseSeries D Convertible Preferred Stock Split, as well as the timing of such events;

the intended benefits of the Reverseor Series D-1 Convertible Preferred Stock Split, including that the Reverse Stock Split is in the best interests of the Company’s stockholders, is expected to result in an increase to the per share trading price of our common stock, and is expected to make such common stock more attractive to a broader range of institutional and other investors;

the market’s near and long term reaction to the increasewould be included in the number of shares of common stock, we are authorized to issue and the ReverseSeries D Convertible Preferred Stock, Split; and

statements regarding our intention to engage in future equity transactions, including a proposed rights offering, each as further provided and described in this Proxy Statement.

Any statements that involve discussions with respect to predictions, estimates, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (which may be identified by words and phrases such as “expects” or “is expected,” “anticipates,” “plans,” “budget,” “scheduled,” “forecasts,” “estimates,” “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, will occur or be achieved) are not statements of historical fact and may be forward-looking statements and are intended to identify forward-looking statements.

These forward-looking statements are based on the beliefs of the Company’s management as well as on assumptions that such management believes to be reasonable, based on information currently availableSeries D-1 Convertible Preferred Stock considered present at the time such statements were made. However,meeting for the purpose of determining whether there can be no assurance that forward-looking statements will prove to be accurate. Such assumptions and factors include, among other things, the anticipated benefits and risks of the amendments to our Certificate of Incorporation to increase the number ofis a quorum. A broker non-vote, being shares of common stock, we are authorizedSeries D Convertible Preferred Stock, or Series D-1 Convertible Preferred Stock not entitled to issue and tovote, would not have any effect on the Reverse Stock Split, each as further provided and described in this Proxy Statement.

By their nature, forward-looking statements are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievementsoutcome of the Company to be materially different from any future results, performance or achievements expressed or implied byvote on Proposals 1, 2, 3, and 6. A broker non-vote would have the forward-looking statements. Forward-looking statements are subject to a variety of risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

difficulties, delays, unanticipated costs or our inability to effectuate the amendment to our Certificate of Incorporation to increase the number of shares of common stock we are authorized to issue and the Reverse Stock Split on the expected terms and conditions or timeline;

difficulties, delays or the inability to increase the per share trading price of our common stocksame effect as a result of the Reverse Stock Split, including future decreases in the price of our common stock due to, among other things, the announcement of the Reverse Stock Split and/or the increase in the number of shares of common stock we are authorized to issue or our inability to make our common stock more attractive to a broader range of institutional or other investors, as a result of, among other things, investors viewing the Reverse Stock Splitvote against Proposals 4 and the increase in the number of shares of common stock we are authorized to issue negatively or due to future financial results, market conditions, the market perception of our business, results from our clinical trials, our inability to realize anticipated cost reductions or other factors adversely affecting the market price of our common stock, notwithstanding the Reverse Stock Split and the increase in the number of shares of common stock we are authorized to issue or otherwise;

unanticipated negative reactions to the Reverse Stock Split and the increase in the number of shares of common stock we are authorized to issue or unanticipated circumstances or results that could negatively affect interest in our common stock by the investment community; or

general business, economic, competitive, political, regulatory and social uncertainties; risks related to competition; risks related to factors beyond the control of the Company; the global economic climate; the execution of strategic growth plans; insurance risks; and litigation.

This list is not exhaustive of the factors that may affect any of the forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain. Actual results could differ materially from those projected in the forward-looking statements as a result of the matters set out in this Proxy Statement generally and certain economic and business factors, some of which may be beyond the control of the Company. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the proposals contained in this Proxy Statement. The Company does not intend, and does not assume, any obligation to update any forward-looking statements, other than as required by applicable law. Accordingly, Company stockholders should not place undue reliance on forward-looking statements.

5.STOCK OWNERSHIP

Directors, Executive Officers, and Other Stockholders

The following table provides information about the beneficial ownership of common stock as of September 15, 2016, byApril 14, 2024, unless otherwise indicated, for (i) each of our directors, (ii) each of our named executive officers andnamed in the “Summary Compensation Table” of this Proxy Statement, (iii) all of our directors and executive officers as a group. We do not believe any persongroup, and (iv) the persons known by us to own beneficially owns more than 5% of our outstanding common stock. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted on at the 2024 Annual Meeting. Each outstanding share of Series D Convertible Preferred Stock entitles its holder to cast one vote on each matter to be voted on at the 2024 Annual Meeting. Each outstanding share of Series D-1 Convertible Preferred Stock entitles its holder to cast ten votes on each matter to be voted on at the 2024 Annual Meeting. Holders of shares of Series D Convertible Preferred Stock and Series D-1 Convertible Preferred Stock will vote together with the holders of common stock as a single class on all matters submitted to stockholders and such other matters as may properly come before the Annual Meeting and any adjournments.

| | | | | | | | |

Name and Address(1)

| | Amount and

Nature of

Beneficial

Ownership(2) | | | Percentage

of Class(3) | |

Directors and Executive Officers:

| | | | | | | | |

H. Craig Dees, Ph.D.(4)

| | | 1,497,859 | (5) | | | * | |

Peter R. Culpepper

| | | 3,474,998 | (6) | | | 1.4 | % |

Timothy C. Scott, Ph.D.

| | | 3,880,966 | (7) | | | 1.6 | % |

Eric A. Wachter, Ph.D.

| | | 7,915,964 | (8) | | | 3.2 | % |

Alfred E. Smith, IV

| | | 250,000 | (9) | | | * | |

Kelly M. McMasters, MD, Ph.D.

| | | 400,000 | (10) | | | * | |

Jan Koe

| | | 1,486,300 | (11) | | | * | |

All directors and executive officers as a group (7 persons**)

| | | 17,408,228 | (12) | | | 7.0 | % |

| Name and Address(1) | | Amount and

Nature of

Beneficial

Ownership(2) | | | Percentage of

Class(2) (3) | |

| Directors and Named Executive Officers: | | | | | | | | |

| Bruce Horowitz | | | 5,486,983 | (6) | | | 1.3 | % |

| Dominic Rodrigues | | | 12,493,631 | (5) | | | 2.9 | % |

| Ed Pershing, CPA | | | 21,569,870 | (4) | | | 4.9 | % |

| Eric Wachter, Ph.D. | | | 20,582,068 | (9) | | | 4.8 | % |

| Heather Raines, CPA | | | 1,910,103 | (8) | | | * | |

| John Lacey, III, M.D. | | | 300,000 | (7) | | | * | |

| Webster Bailey | | | 558,768 | (10) | | | * | |

| All Directors and Executive Officers as a Group (6 Persons) | | | 57,414,460 | (11) | | | 12.8 | % |

| | | | | | | | | |

| 5% Stockholders: | | | | | | | | |

| Jeffery Allen Morris | | | 60,902,310 | (12) | | | 13.2 | % |

| * | Less than 1% of the outstanding shares of common stock. |

** | Excluding Dr. Dees, who is no longer an executive officer. |

| (1) | Each named individual other than Dr. Dees is an officer Drs. Lacey and Wachter, Messrs. Bailey, Pershing, and Rodrigues, and Mrs. Raines are officers and/or directordirectors of Provectus Biopharmaceuticals, Inc., whose business address is 7327 Oak Ridge Highway,800 S. Gay Street, Suite A,1610, Knoxville, TN 37931.Tennessee 37929. Mr. Horowitz resigned as an officer and director of the Company on March 25, 2024. |

| |

| (2) | Shares of common stock that a person has the right to acquire within 60 days of September 15, 2016April 14, 2024 are deemed outstanding for computing the percentage ownership of the person having the right to acquire such shares but are not deemed outstanding for computing the percentage ownership of any other person. Except as indicated by a note, each stockholder listed in the table has sole voting and investment power as to the shares owned by that person. |

| |

| (3) | As of September 15, 2016,April 14, 2024, there were 242,509,352419,522,119 shares of common stock issued and outstanding. As of April 14, 2024, there were 12,373,247 shares of preferred series D stock issued and outstanding that are convertible into 12,373,247 shares of common stock. As of April 14, 2024, there were 10,634,761 shares of preferred series D-1 stock issued and outstanding that are convertible into 106,347,610 shares of common stock and $2,711,028 aggregate principal amount and interest of convertible promissory notes that are convertible within 60 days into 947,250 shares of Series D-1 Convertible Preferred Stock, which are convertible within 60 days into 9,472,500 shares of common stock. |

| |

| (4) | Dr. Dees resignedMr. Pershing’s beneficial ownership includes 60,600 shares of common stock owned by his spouse, 16,500 shares of common stock owned by his spouse through a retirement plan, 3,750 shares of common stock held as Chief Executive Officercustodian for a grandchild, 81,500 shares of common stock owned by Mr. P’s Foundation, a nonprofit corporation of which Mr. Pershing is an affiliate, 550,000 shares of common stock owned by Perkins Place, a general partnership of which Mr. Pershing is an affiliate, 2,820,630 shares of common stock owned by Mr. Pershing through a retirement plan, 1,150,428 shares of Series D-1 Convertible Preferred Stock that are convertible within 60 days into 11,504,280 shares of common stock and Chairman$1,869,633 aggregate principal amount and interest of the Boardconvertible promissory notes that are convertible within 60 days into 653,261 shares Series D-1 Convertible Preferred Stock, which are convertible within 60 days into 6,532,610 shares of Directors effective February 27, 2016.common stock. |

| (5) | Does not include anyMr. Rodrigues’s beneficial ownership includes 500 shares of common stock held solely by Mr. Rodrigues, 509,089 shares of common stock held jointly with his spouse, 112,700 shares of common stock owned by his spouse, 23,700 shares of common stock held as custodian for his children, 431,400 shares of common stock owned through a retirement plan and 11,416,242 shares of Series D Convertible Preferred Stock that are convertible within 60 days into 11,416,242 shares of common stock.

|

| |

| (6) | Mr. Horowitz resigned as an officer and director of the Company on March 25, 2024. Mr. Horowitz’s beneficial ownership includes 2,302,243 shares of common stock held solely by Mr. Horowitz, 50,000 shares of common stock owned by his spouse, 325,000 shares of common stock owned through a retirement plan, 2,425,000 shares of common stock subject to options whichthat are exercisable within 60 days, as all of Dr. Dees’ options have expired as a result of Dr. Dees’ resignation. Dr. Dees pledged 1,000,000and 38,474 shares of his common stock pursuant toSeries D-1 Convertible Preferred Stock that certain Stock Pledge Agreement, dated October 3, 2014, between Dr. Dees and the Company in order to secure Dr. Dees’ obligations under that certain Stipulated Settlement Agreement and Mutual Release between the Company and Dr. Dees, dated June 6, 2014 (“Dees Settlement Agreement”). As a result of Dr. Dees’ resignation from the Company, he was required to pay the Company under the Dees Settlement Agreement the sum of Two Million Two Hundred Sixty Seven Thousand and Seven Hundred Fifty Dollars ($2,267,750) immediately. Dr. Dees’ failure to pay this sum resulted in a breach of the Dees Settlement Agreement, and on March 10, 2016, the Company sent a demand letter for Dr. Dees to cure such defaultare convertible within thirty (30) days. Dr. Dees failed to pay these amounts outstanding under the Settlement Agreement (including interest due thereon) within the thirty (30)60 days cure period. Accordingly, the Company intends to exercise all rights and remedies available to it under the Dees Settlement Agreement, Stock Pledge Agreement and at law and equity, including but not limited to foreclosure of its first-priority security interest in the 1,000,000into 384,740 shares of common stock granted as collateral pursuant to the Stock Pledge Agreement. On May 5, 2016, the Company filed a lawsuit in the United States District Court for the Eastern District of Tennessee at Knoxville (the “Court”) against Dr. Dees and his wife, based upon breach of the Dees Settlement Agreement seeking, among other relief,stock. |

| | appointment of a receiver for the 1,000,000 shares of common stock |

| (7) | Dr. Dees granted as collateral pursuant to the Stock Pledge Agreement. The Court entered a default judgment against Dr. Dees on July 20, 2016; however, the Company cannot predict when these shares will be recovered by the Company. The Court recently issued a Temporary Restraining Order upon the Company’s application for same upon notice that Dr. Dees was attempting to sell his shares of the Company’s common stock. The Temporary Restraining Order was converted to a Preliminary Injunction on September 16, 2016, which order will remain in place until the trial of the underlying lawsuit absent further court order. |

(6) | Mr. Culpepper’sLacey’s beneficial ownership includes 296,503100,000 shares of common stock held insolely by Dr. Lacey, 20,000 shares of common stock held through IMA, 80,000 shares of common stock held through a 401(k) plan, 1,500,000retirement account, and 100,000 shares of common stock subject to options whichthat are exercisable within 60 days and 266,666 shares of common stock issuable upon the exercise of warrants. Mr. Culpepper pledged 1,000,000 shares of his common stock pursuant to that certain Stock Pledge Agreement, dated October 3, 2014, between Mr. Culpepper and the Company in order to secure Mr. Culpepper’s obligations under that certain Stipulated Settlement Agreement and Mutual Release between the Company and Mr. Culpepper, dated June 6, 2014.days. |

(7) | Dr. Scott’s |

| (8) | Mrs. Raines’s beneficial ownership includes 503,125100,000 shares of common stock held in a 401(k) plan, and 1,800,000solely by Mrs. Raines, 1,113,153 shares of common stock subject to optionsheld jointly with her spouse, 20,290 shares of Series D-1 Convertible Preferred Stock that are convertible within 60 days into 202,900 shares of common stock, and $141,395 aggregate principal amount and interest of convertible promissory notes that are convertible within 60 days into 49,405 shares of Series D-1 Convertible Preferred Stock, which are exercisableconvertible within 60 days. Dr. Scott pledged 1,000,000days into 494,050 shares of his common stock pursuant to that certain Stock Pledge Agreement, dated October 3, 2014, between Dr. Scott and the Company in order to secure Dr. Scott’s obligations under that certain Stipulated Settlement Agreement and Mutual Release between the Company and Dr. Scott, dated June 6, 2014.stock. |

(8) | |

| (9) | Dr. Wachter’s beneficial ownership includes 5,714,183 shares held solely by Dr. Wachter, 4,867 shares of common stock held by the Eric A. Wachter 1998 Charitable Remainder Unitrust, 930,248 shares of common stock held inowned by Dr. Wachter through a 401(k)retirement plan, 600,000and 1,393,277 shares of Series D-1 Convertible Preferred Stock that are convertible within 60 days into 13,932,770 shares of common stock subject to options which are exercisable within 60 days and 666,666 shares of common stock issuable upon the exercise of warrants. Dr. Wachter pledged 1,000,000 shares of his common stock pursuant to that certain Stock Pledge Agreement, dated October 3, 2014, between Dr. Wachter and the Company in order to secure Dr. Wachter’s obligations under that certain Stipulated Settlement Agreement and Mutual Release between the Company and Dr. Wachter, dated June 6, 2014.stock. |

(9) | |

| (10) | Mr. Smith’sBailey’s beneficial ownership includes 250,000 shares of common stock subject to options which are exercisable within 60 days. |

(10) | Dr. McMasters’ beneficial ownership includes 400,000 shares of common stock subject to options which are exercisable within 60 days. |

(11) | Mr. Koe’s beneficial ownership includes 200,000 shares of common stock subject to options which are exercisable within 60 days, 150,000145,528 shares of common stock held by Vekoe Partners LLC,as custodian for his children and 41,324 shares of which Mr. Koe is an affiliate, and 350,000Series D-1 Convertible Preferred Stock that are convertible within 60 days into 413,240 shares of common stock. |

| |

| (11) | Includes 11,416,242 shares of Series D Convertible Preferred Stock with are convertible withing 60 day into 11,416.242 shares of common stock, issuable upon the exerciseand 1,803,689 shares of warrants. Mr. Koe disclaims beneficial ownership of the shares held by Vekoe Partners LLC except to the extent of his pecuniary interest therein. |

(12) | Includes 6,033,332Series D-1 Convertible Preferred Stock that are convertible within 60 days into 18,036,890 shares of common stock, subject to options and warrants$2,011,028 aggregate principal and interest amount of convertible promissory notes that are convertible within 60 days into 702,6666 shares of Series D-1 Convertible Preferred Stock, which are exercisableconvertible within 60 days.days into 7,026,660 shares of common stock. |

| |

| (12) | Mr. Morris’ beneficial ownership is based on a Form 4 filed with the SEC on August 14, 2023 and includes 18,500,000 shares of common stock, 3,995,747 shares of Series D-1 Convertible Preferred Stock, which are convertible within 60 days into 39,957,470 shares of common stock, and $700,000 aggregate principal amount of convertible promissory notes that are convertible within 60 days into 244,584 shares of Series D-1 Convertible Preferred Stock, which are convertible within 60 days into 2,444,840 shares of common stock. |

PROPOSAL 1CORPORATE GOVERNANCE

TO APPROVE AND ADOPT AN AMENDMENT TO CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK THAT WE ARE AUTHORIZED TO ISSUE FROM 400,000,000 TO 1,000,000,000 SHARES

Description of the AmendmentBoard Leadership Structure

Our Board consists of four members: Webster Bailey, John Lacey, III, M.D., Ed Pershing, CPA, and Dominic Rodrigues. Mr. Pershing serves as an executive officer and chairman and Mr. Rodrigues serves as an executive officer and vice chairman of our Board.

Two members of our Board, Dr. Lacey and Mr. Bailey, are considered independent under the listing standards of the NYSE American LLC.

Our President, Mr. Rodrigues, serves as our principal executive officer. Our entire Board is responsible for our risk oversight function.

Board and Committees

Our Board met four times and acted by unanimous written consent four times in 2023. Each incumbent director attended all meetings of our Board and its committees on which he served during 2023. We do not have a formal policy regarding attendance by Board members at annual stockholder meetings; however, members of our Board are encouraged to attend these meetings. All our directors attended the 2023 Annual Meeting of Stockholders in person.

We have three standing Board committees: the audit committee, the compensation committee, and the corporate governance and nominating committee (the “nominating committee”).

Audit Committee

The audit committee consists of Dr. Lacey and Messrs. Bailey, Pershing, and Rodrigues. Dr. Lacey and Mr. Bailey are independent directors under the listing standards of the NYSE American LLC. Mr. Pershing is the chairman of our Board’s audit committee. Our Board has determined that Messrs. Pershing and Rodrigues qualify as “audit committee financial experts,” as defined under the rules of the SEC. The audit committee met four times in 2023.

The audit committee’s responsibilities include:

| 1. | Hiring independent registered public accountants to audit our books, records, and financial statements and to review our systems of accounting; |

| | |

| 2. | Discussing with the independent registered public accounting firm the results of the annual audit and quarterly reviews; |

| | |

| 3. | Conducting periodic independent reviews of the systems of accounting; |

| | |

| 4. | Making reports periodically to our Board with respect to its findings; and |

| | |

| 5. | Undertaking other activities described more fully in the section called “Audit Committee Report.” |

Our audit committee charter is posted on our website under the “Investors” subpage at http://provectusbio.com/media/docs/AuditCommitteeCharter.pdf and is also available in print to any stockholder or other interested party who makes such a request of the Company’s Secretary. The information on our website, however, is not a part of this Proxy Statement.

Compensation Committee

The compensation committee consists of Dr. Lacey and Messrs. Bailey, Pershing, and Rodrigues. Dr. Lacey and Mr. Bailey are independent directors under the listing standards of the NYSE American LLC. Mr. Bailey is the chairman of our Board’s compensation committee. The compensation committee met one time in 2023.

The compensation committee’s responsibilities include:

| 1. | Reviewing and approving the annual corporate goals and objectives relevant to each executive officer; at least annually, evaluating each executive officer’s performance in light of these goals and objectives; and setting each executive officer’s compensation, including salary, bonus, and incentive compensation, based on this evaluation; |

| 2. | Reviewing our compensation and benefits plans; |

| | |

| 3. | Reviewing and recommending to the entire Board the compensation for Board members; and |

| | |

| 4. | Other matters that our Board specifically delegates to the compensation committee from time to time. |

Our compensation committee charter is posted on our website under the “Investors” subpage at http://provectusbio.com/media/docs/CompensationCommitteeCharter.pdf and is also available in print to any stockholder or other interested party who makes such a request of the Company’s Secretary. The information on our website, however, is not a part of this Proxy Statement.

Nominating Committee and Director Nominations

Our nominating committee met one time and acted by unanimous written consent one time in 2023. The nominating committee consists of Dr. Lacey and Messrs. Bailey, Pershing, and Rodrigues. Dr. Lacey and Mr. Bailey are independent directors under the listing standards of the NYSE American LLC. Dr. Lacey is the chairman of our Board’s nominating committee. Prior to filing this Proxy Statement, the nominating committee reviewed and approved the nomination of the persons listed below under Proposal 1, Election of Directors has unanimously to serve as members of our Board for a one-year term expiring at the annual meeting of stockholders occurring in 2025. The nominating committee also recommended to our Board that it present all of these Board nominees for approval at the 2024 Annual Meeting.

Our Board adopted a resolution to amendwritten charter for our Certificate of Incorporation to increase the number of shares of common stock that we are authorized to issue from 400,000,000 to 1,000,000,000 shares and has directed that the proposed amendment be submittednominating committee, which is available to our stockholders and other interested parties on our website under the “Investors” subpage, at http://provectusbio.com/media/docs/NominatingCommitteeCharter.pdf, and is also available in print to any stockholder or other interested party who makes such a request of the Company’s Secretary. The information on our website, however, is not a part of this Proxy Statement.

The nominating committee’s responsibilities include:

| 1. | Assisting our Board to identify and approve the nomination of individuals qualified to serve as Board members; |

| | |

| 2. | Reviewing the qualifications and performance of incumbent directors to determine whether to recommend them as nominees for re-election; |

| | |

| 3. | Developing and recommending corporate governance policies for the Company to our Board; |

| | |

| 4. | Periodically reviewing the management succession plan of the Company, and formally recommending to our Board, as needed, successors to departing executive officers if a vacancy occurs; and |

| | |

| 5. | Evaluating the performance of our Board. |

Our nominating committee has no set procedures or policy on the selection of nominees or evaluation of stockholder recommendations and will consider these issues on a case-by-case basis. Our nominating committee will consider stockholder recommendations for their approvaldirector nominees that are properly received in accordance with our bylaws and adoption. The amendment willthe applicable rules and regulations of the SEC. Our nominating committee screens all potential candidates in the same manner. Our nominating committee’s review typically would be based on all information provided with respect to the potential candidate. Our nominating committee has not changeestablished specific minimum qualifications that must be met by a nominee for a position on our Board or specific qualities and skills for a director. Our nominating committee may consider the numberdiversity of qualities and skills of a nominee, but our nominating committee has no formal policy in this regard. For more information, please see the section below entitled “ADDITIONAL INFORMATION.”

Stockholders who wish to contact Board members may do so by sending an e-mail addressed to them at info@provectusbio.com.

COMPENSATION Of Directors and Executive Officers

Because we are a smaller reporting company, we are not required to include a Compensation Discussion and Analysis section in this Proxy Statement and have elected to comply with the scaled-down executive compensation disclosure requirements applicable to smaller reporting companies.

Executive Employment/Contractor Agreements

On March 25, 2019, our Board promoted Mrs. Raines to be the Company’s Chief Financial Officer (“CFO”). She previously served as Provectus’s Controller from August 1, 2017 until March 25, 2019. In connection with her promotion to CFO, Mrs. Raines received an initial incentive compensation of 50,000 shares of preferred stockthe Company’s common stock. Pursuant to the employment agreement with Mrs. Raines (the “Raines Agreement”), the term of Mrs. Raines’ employment extends automatically for one year unless terminated by either the Company or Mrs. Raines upon 30 days prior written notice. Mrs. Raines’s initial base salary is $125,000 per year. In the event Mrs. Raines’ employment with the Company is terminated by Mrs. Raines prior to, but not coincident with, a Change in Control (as defined in the Raines Agreement) or by reason of her death, disability, or retirement prior to a Change in Control, she will be entitled to receive (i) her unpaid base salary through the last day of the month in which the date of termination occurs; (ii) the pro rata portion of any unpaid incentive or bonus payment which has been earned prior to the date of termination; (iii) any benefits to which she may be entitled as a result of such termination (or death), under the terms and conditions of the pertinent plans or arrangements in effect at the time of the notice of termination; and (iv) any expense reimbursements due to Mrs. Raines as of the date of termination. In the event that coincident with or following a Change in Control (as defined in the Raines Agreement), Mrs. Raines’ employment with the Company is terminated or the Raines Agreement is not extended (A) by action of Mrs. Raines coincident with or following a Change in Control including her death, disability or retirement, or (B) by action of the Company not For Cause (as defined in the Raines Agreement) coincident with or following a Change in Control, the Company shall pay Mrs. Raines the compensation and benefits described in the sentence above, as well as a severance payment equal to 50% of her base salary in the preceding calendar year, payable over six months.

On May 8, 2019, our Board promoted Mr. Horowitz to the Company’s COO. During 2017, the Company entered into an independent contractor agreement with Mr. Horowitz, as amended, pursuant to which he served as Chief Operations Consultant of the Company from April 19, 2017 (the “Horowitz Agreement”). The Horowitz Agreement was amended on May 8, 2019 to provide that Mr. Horowitz continue to be paid $125 per hour with a maximum 160 hours per month and receive a health insurance allowance of $1,200 per calendar month. On March 25, 2024, Mr. Horowitz resigned as COO and as a Board member. The Company and Mr. Horowitz entered into an Independent Contractor and Director Fee Termination Agreement and Release (the “Termination Agreement”) to terminate the Horowitz Agreement. The Termination Agreement provides for the Company to pay Mr. Horowitz an initial payment of $250,000 within two business days of the Termination Agreement and a discounted second payment in the amount of $258,000 so long as it is paid prior to June 30, 2024, after which the amount of the second payment is $500,000.

On May 17, 2019, our Board retained Eric A. Wachter, Ph.D. as the Company’s Chief Technology Officer under a new employment agreement effective as of May 20, 2019 (the “Wachter Agreement”). The Wachter Agreement provides that Dr. Wachter will be employed for an initial term of one year, subject to automatic renewal for successive one-year periods, unless the Company or Dr. Wachter provides notice of intent not to renew. Dr. Wachter’s initial base salary is $240,000 per year. Dr. Wachter has the right to continue to participate in employee benefit plans. In the event Dr. Wachter’s employment with the Company is terminated by Dr. Wachter prior to, but not coincident with, a Change in Control (as defined in the Wachter Agreement) or by reason of his death, disability, or retirement prior to a Change in Control, he will be entitled to receive (i) his unpaid base salary through the last day of the month in which the date of termination occurs; (ii) the pro rata portion of any unpaid incentive or bonus payment which has been earned prior to the date of termination; (iii) any benefits to which he may be entitled as a result of such termination (or death), under the terms and conditions of the pertinent plans or arrangements in effect at the time of the notice of termination; and (iv) any expense reimbursements due to Dr. Wachter as of the date of termination. In the event that coincident with or following a Change in Control (as defined in the Wachter Agreement), Dr. Wachter’s employment with the Company is terminated or the Wachter Agreement is not extended (A) by action of Dr. Wachter coincident with or following a Change in Control including his death, disability or retirement, or (B) by action of the Company not For Cause (as defined in the Wachter Agreement) coincident with or following a Change in Control, the Company shall pay Dr. Wachter the compensation and benefits described in the sentence above, as well as a severance payment equal to 50% of his base salary in the preceding calendar year, payable over six months.

On April 16, 2024, our Board appointed Mr. Pershing to be the Company’s Chief Executive Officer (“CEO”). He has served as Provectus’s Chairman of the Board of Directors since April 1, 2017. Pursuant to the employment agreement with Mr. Pershing (the “Pershing Agreement”), the term of his employment commenced on April 16, 2024 and ends on April 15, 2029, unless further extended or sooner terminated as hereinafter provided. On April 15, 2025 and on April 15th of each year thereafter, the terms of the Executive’s employment hereunder shall be automatically extended one year thereafter, the term of the Executive’s employment hereunder shall be extended one (1) additional year, unless ninety (90) days prior to the date of such automatic extension the Company shall have delivered to the Executive or the Executive shall have delivered to the Company written notice that the term of the Executive’s employment hereunder shall not be extended. Mr. Pershing’s initial base salary is $240,000 per year. In the event Mr. Pershing’ employment with the Company is terminated by Mr. Pershing prior to, but not coincident with, a Change in Control (as defined in the Pershing Agreement) or by reason of his death, disability, or retirement prior to a Change in Control, he will be entitled to receive (i) his unpaid base salary through the last day of the month in which the date of termination occurs; (ii) the pro rata portion of any unpaid incentive or bonus payment which has been earned prior to the date of termination; (iii) any benefits to which he may be entitled as a result of such termination (or death), under the terms and conditions of the pertinent plans or arrangements in effect at the time of the notice of termination; and (iv) any expense reimbursements due to Mr. Pershing as of the date of termination. In the event that coincident with or following a Change in Control (as defined in the Pershing Agreement), Mr. Pershing’ employment with the Company is terminated or the Pershing Agreement is not extended (A) by action of Mr. Pershing coincident with or following a Change in Control including his death, disability or retirement, or (B) by action of the Company not For Cause (as defined in the Pershing Agreement) coincident with or following a Change in Control, the Company shall pay Mr. Pershing the compensation and benefits described in the sentence above, as well as an amount equal to ten (10) times the Base Salary paid to Executive in the preceding calendar year, payable over three (3) months.

The Company entered into an independent contractor agreement with Mr. Rodrigues pursuant to which he served as Chief Operations Consultant of the Company from March 25 to April 15, 2024. On April 16, 2024, our Board appointed Mr. Rodrigues to be the Company’s President. He has served as Provectus’s Vice-Chairman of the Board of Directors since April 1, 2017. Pursuant to the employment agreement (the “Rodrigues Agreement”), the term of his employment commenced on April 16, 2024 and ends on April 15, 2029, unless further extended or sooner terminated as hereinafter provided. On April 15, 2025 and on April 15th of each year thereafter, the terms of the Executive’s employment hereunder shall be automatically extended one year thereafter, the term of the Executive’s employment hereunder shall be extended one (1) additional year, unless ninety (90) days prior to the date of such automatic extension the Company shall have delivered to the Executive or the Executive shall have delivered to the Company written notice that the term of the Executive’s employment hereunder shall not be extended. Mr. Rodrigues’s initial base salary is $240,000 per year. In the event Mr. Rodrigues’ employment with the Company is terminated by Mr. Rodrigues prior to, but not coincident with, a Change in Control (as defined in the Rodrigues Agreement) or by reason of his death, disability, or retirement prior to a Change in Control, he will be entitled to receive (i) his unpaid base salary through the last day of the month in which the date of termination occurs; (ii) the pro rata portion of any unpaid incentive or bonus payment which has been earned prior to the date of termination; (iii) any benefits to which he may be entitled as a result of such termination (or death), under the terms and conditions of the pertinent plans or arrangements in effect at the time of the notice of termination; and (iv) any expense reimbursements due to Mr. Rodrigues as of the date of termination. In the event that coincident with or following a Change in Control (as defined in the Rodrigues Agreement), Mr. Rodrigues’ employment with the Company is terminated or the Rodrigues Agreement is not extended (A) by action of Mr. Rodrigues coincident with or following a Change in Control including his death, disability or retirement, or (B) by action of the Company not For Cause (as defined in the Rodrigues Agreement) coincident with or following a Change in Control, the Company shall pay Mr. Rodrigues the compensation and benefits described in the sentence above, as well as an amount equal to ten (10) times the Base Salary paid to Executive in the preceding calendar year, payable over three (3) months. On April 16, 2024, the Company and Mr. Rodrigues mutually terminated the independent contractor agreement.

Bonus Awards

No bonuses were awarded to our named executive officers in 2023.

Other Benefits

We maintain broad-based benefits that are authorized,provided to all employees, including health insurance, life and the total authorized shares of capital stock will be increased from 425,000,000 to 1,025,000,000. The amendment will replace Article IV, Section A of our current Certificate of Incorporation with the following language:

The total number of shares which the Corporation shall have authority to issue is 1,025,000,000 shares of capital stock, of which 1,000,000,000 shares shall be designated Common Stock, $0.001 par value per share (“Common Stock”),disability insurance, dental insurance, and 25,000,000 shall be designated Preferred Stock, $0.001 par value per share (“Preferred Stock”).

Background

We may issue shares of capital stock to the extent such shares have been authorized under our Certificate of Incorporation. Our Certificate of Incorporation currently authorizes us to issue up to 400,000,000 shares of common stock and 25,000,000 shares of preferred stock, par value $.001 per share.

As of September 26, 2016, the total shares of common stock issued and outstanding and reserved for issuance pursuant to outstanding warrants and options totaled 355,104,037. No shares of common stock are held in treasury. The aggregate amount of common stock issued and reserved for issuance consisted of the following amounts as of September 26, 2016:a vacation policy.

242,929,352 sharesLong-Term Incentives

At the 2014 annual meeting of common stock issued and outstanding;

101,874,685 shares of common stock reserved for issuance pursuant to outstanding warrants to purchase common stock;

6,800,000 shares of common stock reserved for issuance pursuant to outstanding options to purchase common stock; and

3,500,000 shares of common stock reserved for issuance upon conversion ofstockholders, our Series B Convertible Preferred Stock (including shares of common stock issuable in satisfaction of our dividend obligations on such outstanding shares of Series B Convertible Preferred Stock).

Reasons for the Proposed Amendment